Executive Summary

Haverty Furniture Companies, Inc. operates as a specialty retailer of residential furniture and accessories in the United States. The company offers furniture merchandise under the Havertys brand name. It also provides custom upholstery products; and mattress product lines under the Sealy, Tempur-Pedic, Serta, Stearns & Foster, Beautyrest Black, and Scott Living names, as well as private label Skye name. The company sells home furnishings through its retail stores, as well as through its Website. As of April 01, 2020, it operated 120 showrooms in 16 states in the Southern and Midwestern regions. Haverty Furniture Companies, Inc. was founded in 1885 and is headquartered in Atlanta, Georgia.

STRENGTHS

- Margins: Continues to generate strong profit margin as compared to its peers.

- Financial Health: 'Comfortable' liquidity position to honour its near term debt obligations.

- Cash Flow Management: Achieved healthy cash flows despite challenging business environment.

- Operating Efficiency: 'Robust' top-line performance, exceeding most of its peers.

WEAKNESSES

SIMILAR COMPANIES

TICKER: RH

TICKER: WSM

TICKER: SNBR

1.2Stores & Square Footage

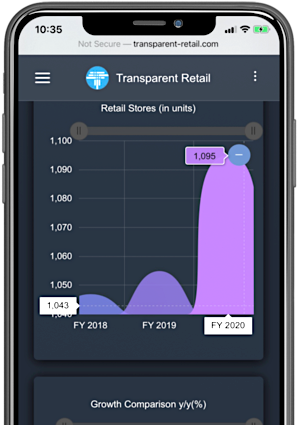

1.2.1Retail Stores (in units)

120 Stores

Retail Stores

1 Stores

Growth y/y (in units)

0.83%

Growth y/y (%)

| Company - Retail Stores |

Furniture & Home - Retail Stores |

|

|---|---|---|

| Annual Growth (%) | -0.8% | -1.9% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | 0% | 0% |

| Top Furniture & Home Companies by Retail Stores - Retail Stores & Growth y/y (%) |

|

|---|---|

| Rent-A-Center, Inc. Growth y/y (%) | 1,966 -36.46% |

| Bed Bath & Beyond Inc. Growth y/y (%) | 1,391 -8.73% |

| Aaron's, Inc. Growth y/y (%) | 1,092 -6.43% |

| Top Furniture & Home Companies by % △ in Retail Stores - Retail Stores & Growth y/y (%) |

|

|---|---|

| Floor & Decor Holdings, Inc. Growth y/y (%) | 133.00 10.83% |

| Conn's, Inc. Growth y/y (%) | 143.00 4.38% |

| At Home Group Inc. Growth y/y (%) | 219.00 3.30% |

- Retail Stores: At the end of Q4 2020, HVT operated 120 retail stores, a decline of 0.83% YoY.

- Growth QoQ: HVT's total retail stores in Q4 2020, remained unchanged QoQ.

1.2.2Gross Sq. Ft.(in Million)

4.35 Sq. Ft.

Gross Sq. Ft. (in million)

0.07 Sq. Ft.

Growth y/y (in million)

1.67%

Growth y/y (%)

| Company - Gross Sq. Ft. |

Furniture & Home - Gross Sq. Ft. |

|

|---|---|---|

| Annual Growth (%) | -1.7% | -1.7% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | -0.9% | -0% |

| Top Furniture & Home Companies by Gross Sq. Ft. - Gross Sq. Ft. & Growth y/y (%) |

|

|---|---|

| Bed Bath & Beyond Inc. Growth y/y (%) | 39.19mn -8.22% |

| At Home Group Inc. Growth y/y (%) | 23.00mn 3.30% |

| Rent-A-Center, Inc. Growth y/y (%) | 11.65mn -29.95% |

| Top Furniture & Home Companies by % △ in Gross Sq. Ft. - Gross Sq. Ft. & Growth y/y (%) |

|

|---|---|

| Floor & Decor Holdings, Inc. Growth y/y (%) | 10.37mn 13.75% |

| RH Growth y/y (%) | 1.16mn 5.94% |

| Conn's, Inc. Growth y/y (%) | 5.20mn 5.41% |

- Gross Sq.Ft.: At the end of Q4 2020, gross absorption of company-operated retail stores decreased by 1.67% YoY to 4.35 million sq.ft.

- Growth QoQ(%): At the end of Q4 2020, gross absorption of company-operated retail stores decreased by 0.85% QoQ.

1.2.3Average Store Size (in Sq. Ft.)

36266.67 Sq. Ft.

Average Sq. Ft. (in units)

311.85 Sq. Ft.

Growth y/y (in units)

0 Sq. Ft.

Furniture & Home: Growth y/y (in units)

| Company - Avg. Sq. Ft. |

Furniture & Home - Average Sq. Ft. |

|

|---|---|---|

| Annual Growth (%) | -0.9% | 0.6% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | -0.9% | 0% |

| Top Furniture & Home Companies by Average Sq. Ft. - Average Sq. Ft. & Growth y/y (%) |

|

|---|---|

| At Home Group Inc. Growth y/y (%) | 105,000 0.00% |

| Floor & Decor Holdings, Inc. Growth y/y (%) | 78,000 2.63% |

| Conn's, Inc. Growth y/y (%) | 36,337 0.99% |

| Top Furniture & Home Companies by % △ in Avg. Sq. Ft. - Average Sq. Ft. & Growth y/y (%) |

|

|---|---|

| Rent-A-Center, Inc. Growth y/y (%) | 5,928 10.24% |

| RH Growth y/y (%) | 14,134 9.82% |

| Floor & Decor Holdings, Inc. Growth y/y (%) | 78,000 2.63% |

- Average Store Size: In Q4 2020, the average store size of company-operated retail stores reduced by 0.85% YoY to 36266.7 sq.ft.

- Growth QoQ(%): In Q4 2020, the average store size of company-operated retail stores decreased by 0.85% QoQ.

1.3Store Efficiency

1.3.1Sales per Sq. Ft.(in USD)

$55.4

Sales per Sq. Ft.

14.66%

Growth y/y (%)

14.66%

Furniture & Home: Growth y/y (%)

| Company - Sales per Sq. Ft. |

Furniture & Home - Sales per Sq. Ft. |

|

|---|---|---|

| Annual Growth (%) | 14.7% | 14.7% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | 11.8% | 11.8% |

| Sales per Sq.ft-TTM Growth (%) | $170.9Mn -5.5% | - -2.5% |

| Sales per Sq.ft-YTMRQ Growth (%) | $170.9Mn -5.5% | - - |

| Top Furniture & Home Companies by Sales per Sq. Ft. - Sales per Sq. Ft. & Growth y/y (%) |

|

|---|---|

| RH Growth y/y (%) | $728.23 17.59% |

| Williams-Sonoma, Inc. Growth y/y (%) | $409.44 23.17% |

| Sleep Number Corp. Growth y/y (%) | $274.92 20.03% |

| Top Furniture & Home Companies by % △ in Sales per Sq. Ft. - Sales per Sq. Ft. & Growth y/y (%) |

|

|---|---|

| Rent-A-Center, Inc. Growth y/y (%) | $58.33 50.47% |

| At Home Group Inc. Growth y/y (%) | $24.44 36.79% |

| Williams-Sonoma, Inc. Growth y/y (%) | $409.44 23.17% |

- Sales per Sq.Ft.: In Q4 2020, the Company's retail sales per sq.ft. increased by 14.66% YoY to $55.4 per sq.ft.

- Growth QoQ(%): In Q4 2020, its retail sales per sq.ft. increased by 11.79% QoQ.

- 12-Month Sales per Sq.Ft.: For the period ended 12M 2020, retail sales per sq.ft. was $170.88 compared to $180.73 during the same period last year.

- TTM Sales per Sq.Ft.: Trailing 12-months' retail sales per sq.ft. was $170.88 compared to $180.73 during the same period last year.

1.3.2Sales per Store (in Million USD)

$2.01 Mn

Sales per Store

13.68%

Growth y/y (%)

10.59%

Furniture & Home: Growth y/y (%)

| Company - Sales per Store |

Furniture & Home - Sales per Store |

|

|---|---|---|

| Annual Growth (%) | 13.7% | 10.6% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | 10.8% | 10.8% |

| Sales per Store-TTM Growth (%) | $6.2Mn -6.2% | - -2.6% |

| Sales per Store-YTMRQ Growth (%) | $6.2Mn -6.2% | - - |

| Top Furniture & Home Companies by Sales per Store - Sales per Store & Growth y/y (%) |

|

|---|---|

| RH Growth y/y (%) | $10.29Mn 29.13% |

| Floor & Decor Holdings, Inc. Growth y/y (%) | $5.43Mn 24.82% |

| Williams-Sonoma, Inc. Growth y/y (%) | $2.76Mn 25.24% |

| Top Furniture & Home Companies by % △ in Sales per Store - Sales per Store & Growth y/y (%) |

|

|---|---|

| Rent-A-Center, Inc. Growth y/y (%) | $0.35Mn 65.89% |

| At Home Group Inc. Growth y/y (%) | $2.57Mn 36.79% |

| RH Growth y/y (%) | $10.29Mn 29.13% |

- Sales per Store: In Q4 2020, the Company's retail sales per store increased by 13.68% YoY to $2.01 million.

- Growth QoQ(%): In Q4 2020, its retail sales per store increased by 10.84% QoQ.

- 12-Month Sales per Store: For the period ended 12M 2020, retail sales per store was $6.23 million compared to $6.64 million during the same period last year.

- TTM Sales per Store: Trailing 12-months' retail sales per store was $6.23 million compared to $6.64 million during the same period last year.

1.4Stores By Region

- US Stores: The Company ended Q4 2020 with 120 company-operated stores in the U.S., a decline of 0.83% YoY.

- US Stores' Growth QoQ(%): At the end of Q4 2020, company-operated stores in the U.S. remained unchanged QoQ.

1.5Stores By Ownership (in units)

38.04 Stores

Company Owned Stores (in units)

81.96 Stores

Leased Stores (in units)

31.7%

Company Owned Stores (%)

| Company - Owned Stores |

Furniture & Home - Owned Stores |

Company - Leased Stores |

Furniture & Home - Leased Stores |

|

|---|---|---|---|---|

| Annual Growth (%) | -2.5% | 0% | 0% | -3.5% |

| 3-Year CAGR (%) | - | - | - | - |

| As a % of Total Stores | 31.7% | 31.7% | 68.3% | 68.3% |

| Quarter Growth (%) | 0% | 0% | 0% | 0% |

| Top Furniture & Home Companies by Owned Stores (%) - Owned Stores & Owned Stores (%) |

|

|---|---|

| La-Z-Boy Inc. Owned Stores (%) | 158.00 45.01% |

| Ethan Allen Interiors Inc. Owned Stores (%) | 50.98 35.40% |

| Haverty Furniture Companies, Inc. Owned Stores (%) | 38.04 31.70% |

| Top Furniture & Home Companies by Leased Stores (%) - Leased Stores & Leased Stores (%) |

|

|---|---|

| Floor & Decor Holdings, Inc. Leased Stores (%) | 133.00 100.00% |

| Sleep Number Corp. Leased Stores (%) | 602.00 100.00% |

| The Container Store Group, Inc. Leased Stores (%) | 93.00 100.00% |

- Comment: At the end of Q4 2020,68.3% of the Company's total retail stores were leased, while the rest were company-owned stores.

1.6Same Store Sales (%)

1.6.1Same Store Sales

13.7%

Growth y/y (%)

1.4%

Growth y/y (%) – last year

6.3%

Furniture & Home - Growth y/y (%)

| Top Furniture & Home Companies by Same Store Sales (%) | HOME | WSM | FND | Same Store Sales (%) | 30.8% | 24.4% | 21.6% |

|---|---|---|---|

| Same Store Sales (%) – Last Year | 12.3% | 5.5% | 5.2% |

- Same Store Sales: HVT's same store sales increased by 13.7% in Q4 2020, compared to a 13.7 increase in 213.84.

1.7Brand Efficiency

1.7.1Sales By Brand (in $ Mn)

1.7.2Stores by Brand(in Units)

1.7.3Square Feet by Brand(in Million)

1.7.4Average Store Size by Brand (in Sq.ft.)

1.7.5Sales per Store by Brand (in million USD)

1.7.6Sales per SQFT by Brand (in USD)

1.8Stores & Sq. Ft. By Brand & Region

1.8.1Stores by Brand & Region

1.8.2Sq. Ft. By Brand & Region

2Financial Analysis

Analysis of HVT's financial ratios.

2.1Margins & Returns (%)

2.1.1Gross Margin (%)

The ratio of a company's gross margin to its revenue. Gross Margin = Gross Profit Total Revenue (in %)

| The ratio of a company's gross margin to its revenue. | |

| Gross Margin = | Gross Profit |

| Total Revenue (in %) | |

57.08%

Gross Margin (%)

54.17%

Gross Margin (%) – Last Year

45.59%

Furniture & Home: Gross Margin (%)

| Company - Gross Margin |

Furniture & Home - Gross Margin |

|

|---|---|---|

| Annual Growth (%) | 5.4% | 0.8% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | 1.6% | -0.1% |

| G Margin (%)-TTM Growth (%) | $56Mn 3.4% | - 0.8% |

| G Margin (%)-YTMRQ Growth (%) | $56Mn 3.4% | - - |

| Top Furniture & Home Companies by Gross Margin - Gross Margin (%) & Growth y/y (%) |

|

|---|---|

| Aaron's, Inc. Growth y/y (%) | 63.42% -34.35% |

| Sleep Number Corp. Growth y/y (%) | 62.67% 0.13% |

| Rent-A-Center, Inc. Growth y/y (%) | 59.65% -3.10% |

| Top Furniture & Home Companies by % △ in Gross Margin - Gross Margin (%) & Growth y/y (%) |

|

|---|---|

| At Home Group Inc. Growth y/y (%) | 38.87% 35.49% |

| Wayfair Inc. Growth y/y (%) | 29.00% 27.26% |

| Kirkland's, Inc. Growth y/y (%) | 37.97% 27.21% |

- Gross Margin (%): HVT generated a gross margin of 57.08% in Q4 2020, higher than its peer group's median (45.59%).

- Growth QoQ(%): Achieved a margin growth of 1.62% QoQ in Q4 2020, exceeding its peer group's median (-0.38%).

- Growth YoY(%): Achieved a margin growth of 5.38% YoY in Q4 2020, exceeding its peer group's median (0.78%).

- 12M Gross Margin (%): Gross margin was at 56.02% in 12M 2020 compared to 54.16% in same period last year.

- TTM Gross Margin (%): Trailing 12-months' gross margin was at 56.02%, compared to 54.16% during the same period last year.

2.1.2EBITDA MARGIN (%)

A profitability ratio that measures how much in earnings a company is generating before interest, taxes, depreciation, and amortization, as a percentage of revenue. EBITDA Margin = EBITDA(Earnings Before Interest, Tax, Depreciation & Ammortiazation) Total Revenue

| A profitability ratio that measures how much in earnings a company is generating before interest, taxes, depreciation, and amortization, as a percentage of revenue. | |

| EBITDA Margin = | EBITDA(Earnings Before Interest, Tax, Depreciation & Ammortiazation) |

| Total Revenue | |

14.71%

EBITDA Margin (%)

5.83%

EBITDA Margin (%) – Last Year

10.8%

Furniture & Home: EBITDA Margin (%)

| Company - EBITDA Margin |

Furniture & Home - EBITDA Margin |

|

|---|---|---|

| Annual Growth (%) | 152.2% | 60.4% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | 11.7% | -13.3% |

| EBITDA (%) –TTM Growth (%) | $12.7Mn 111.7% | - -10.8% |

| EBITDA (%) –YTMRQ Growth (%) | $12.7Mn 111.7% | - - |

| Top Furniture & Home Companies by EBITDA Margin - EBITDA Margin (%) & Growth y/y (%) |

|

|---|---|

| Williams-Sonoma, Inc. Growth y/y (%) | 18.24% 76.99% |

| Kirkland's, Inc. Growth y/y (%) | 17.25% 2567.32% |

| RH Growth y/y (%) | 16.31% -1.90% |

| Top Furniture & Home Companies by % △ in EBITDA Margin - EBITDA Margin (%) & Growth y/y (%) |

|

|---|---|

| Kirkland's, Inc. Growth y/y (%) | 17.25% 2567.32% |

| Bassett Furniture Industries, Inc. Growth y/y (%) | 11.22% 669.85% |

| Haverty Furniture Companies, Inc. Growth y/y (%) | 14.71% 152.25% |

- EBITDA Margin (%): HVT generated an EBITDA margin of 14.71% in Q4 2020, higher than its peer group median (11.99%).

- Growth QoQ(%): Achieved a margin growth of 11.67% QoQ in Q4 2020, exceeding its peer group median (-13.25%).

- Growth YoY(%): Achieved a margin growth of 152.25% YoY in Q4 2020, exceeding its peer group median (60.37%).

- 12M EBITDA Margin (%): EBITDA margin was at 12.68% in 12M 2020 compared to 5.99% in same period last year.

- TTM EBITDA Margin (%): Trailing 12-months' EBITDA margin was at 12.68%, compared to 5.99% during the same period last year.

2.1.3Operating Margin (%)

A profitability ratio that measures how much in earnings a company is generating before interest, taxes, depreciation, and amortization, as a percentage of revenue. Operating Margin = Operation Income or EBIT (Earning Before Income & Tax) Total Revenue

| A profitability ratio that measures how much in earnings a company is generating before interest, taxes, depreciation, and amortization, as a percentage of revenue. | |

| Operating Margin = | Operation Income or EBIT (Earning Before Income & Tax) |

| Total Revenue | |

12.95%

EBIT Margin (%)

3.41%

EBIT Margin (%) – Last Year

8.94%

Furniture & Home: EBIT Margin (%)

| Company - EBIT Margin |

Furniture & Home - EBIT Margin |

|

|---|---|---|

| Annual Growth (%) | 280% | 97.6% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | 15% | -6.1% |

| EBIT (%) –TTM Growth (%) | $10.2Mn 199.5% | - -0.6% |

| EBIT (%) –YTMRQ Growth (%) | $10.2Mn 199.5% | - - |

| Top Furniture & Home Companies by EBIT Margin - EBIT Margin (%) & Growth y/y (%) |

|

|---|---|

| At Home Group Inc. Growth y/y (%) | 17.84% 133.93% |

| Williams-Sonoma, Inc. Growth y/y (%) | 15.56% 120.32% |

| Kirkland's, Inc. Growth y/y (%) | 14.45% 680.89% |

| Top Furniture & Home Companies by % △ in EBIT Margin - EBIT Margin (%) & Growth y/y (%) |

|

|---|---|

| Kirkland's, Inc. Growth y/y (%) | 14.45% 680.89% |

| Haverty Furniture Companies, Inc. Growth y/y (%) | 12.95% 280.03% |

| Bassett Furniture Industries, Inc. Growth y/y (%) | 8.49% 270.88% |

- Operating Margin (%): HVT generated an operating margin of 12.95% in Q4 2020, higher than its peer group's median (8.7%).

- Growth QoQ(%): Achieved a margin growth of 15.03% QoQ in Q4 2020, exceeding its peer group's median (-15.33%).

- Growth YoY(%): Achieved a margin growth of 280.03% YoY in Q4 2020, exceeding its peer group's median (97.59%).

- 12M operating Margin (%): Operating margin was at 10.24% in 12M 2020 compared to 3.42% in same period last year.

- TTM operating Margin (%): Trailing 12-months' operating margin was at 10.24%, compared to 3.42% during the same period last year.

2.1.4Net Margin (%)

The ratio of a company's net profit to its revenue. Net Margin = Net Profit or Profit After Tax (PAT) Total Revenue

| The ratio of a company's net profit to its revenue. | |

| Net Margin = | Net Profit or Profit After Tax (PAT) |

| Total Revenue | |

10.55%

PAT Margin (%)

2.85%

PAT Margin (%) – Last Year

7.5%

Furniture & Home: PAT Margin (%)

| Company - PAT Margin |

Furniture & Home - PAT Margin |

|

|---|---|---|

| Annual Growth (%) | 269.7% | 105.6% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | 25.6% | 18.7% |

| PAT (%) – TTM Growth (%) | $7.9Mn 190.2% | - 7.9% |

| PAT (%) – YTMRQ Growth (%) | $7.9Mn 190.2% | - - |

| Top Furniture & Home Companies by PAT Margin - PAT Margin (%) & Growth y/y (%) |

|

|---|---|

| At Home Group Inc. Growth y/y (%) | 12.94% 122.97% |

| Tuesday Morning Corp. Growth y/y (%) | 11.53% 368.72% |

| Williams-Sonoma, Inc. Growth y/y (%) | 11.43% 120.77% |

| Top Furniture & Home Companies by % △ in PAT Margin - PAT Margin (%) & Growth y/y (%) |

|

|---|---|

| The Container Store Group, Inc. Growth y/y (%) | 7.14% 576.87% |

| Kirkland's, Inc. Growth y/y (%) | 10.82% 560.59% |

| Tuesday Morning Corp. Growth y/y (%) | 11.53% 368.72% |

- Net Margin (%): HVT generated a net margin of 10.55% in Q4 2020, higher than its peer group's median (7.5%).

- Growth QoQ(%): Achieved a margin growth of 25.63% QoQ in Q4 2020, exceeding its peer group's median (-0.4%).

- Growth YoY(%): Achieved a margin growth of 269.74% YoY in Q4 2020, exceeding its peer group's median (105.62%).

- 12M net Margin (%): Net margin was at 7.91% in 12M 2020 compared to 2.73% in same period last year.

- TTM net Margin (%): Trailing 12-months' net margin was at 7.91%, compared to 2.73% during the same period last year.

2.1.5Return on Investment (%)

ROI (Return on Investment) is a profitability measure which shows how efficiently Company's management is using its assets to generate profits. ROI = Net Income Total Assets

| ROI (Return on Investment) is a profitability measure which shows how efficiently Company's management is using its assets to generate profits. | |

| ROI = | Net Income |

| Total Assets | |

8.69%

ROI (%)

3.9%

ROI (%) – Last Year

3.12%

Furniture & Home: ROI (%)

| Company - ROI (%) |

Furniture & Home - ROI (%) |

|

|---|---|---|

| Annual Growth (%) | 122.7% | 4.9% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | 52.7% | 20% |

| Top Furniture & Home Companies by ROI - Return on Investment (%) & Growth y/y (%) |

|

|---|---|

| Sleep Number Corp. Growth y/y (%) | 17.40% 71.32% |

| Williams-Sonoma, Inc. Growth y/y (%) | 12.48% 43.19% |

| Rent-A-Center, Inc. Growth y/y (%) | 11.88% 8.37% |

| Top Furniture & Home Companies by % △ in ROI - Return on Investment (%) & Growth y/y (%) |

|

|---|---|

| Sleep Number Corp. Growth y/y (%) | 17.40% 71.32% |

| Williams-Sonoma, Inc. Growth y/y (%) | 12.48% 43.19% |

| Rent-A-Center, Inc. Growth y/y (%) | 11.88% 8.37% |

- Return on Investment (%): HVT generated a return on investment of 8.69% in Q4 2020, higher than its peer group's median (0.89%).

- Growth QoQ(%): Achieved a return on investment growth of 52.7% QoQ in Q4 2020, exceeding its peer group's median (10.21%).

- Growth YoY(%): Achieved a return on investment growth of 122.69% YoY in Q4 2020, exceeding its peer group's median (-8.73%).

2.1.6Return on Equity (%)

ROE (Return on Equity) is a profitability measure which shows how efficiently a Company's management team has used its shareholder money to generate profits. ROE = Net Income Total Shareholders Equity

| ROE (Return on Equity) is a profitability measure which shows how efficiently a Company's management team has used its shareholder money to generate profits. | |

| ROE = | Net Income |

| Total Shareholders Equity | |

23.38%

ROE (%)

8.39%

ROE (%) – Last Year

4.01%

Furniture & Home: ROE (%)

| Company - ROE (%) |

Furniture & Home - ROE (%) |

|

|---|---|---|

| Annual Growth (%) | 178.6% | -10% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | 57% | 24.5% |

| Top Furniture & Home Companies by ROE - Return on Equity (%) & Growth y/y (%) |

|

|---|---|

| RH Growth y/y (%) | 70.76% 0.00% |

| Williams-Sonoma, Inc. Growth y/y (%) | 38.36% 25.73% |

| Rent-A-Center, Inc. Growth y/y (%) | 35.14% -7.07% |

| Top Furniture & Home Companies by % △ in ROE - Return on Equity (%) & Growth y/y (%) |

|

|---|---|

| Haverty Furniture Companies, Inc. Growth y/y (%) | 23.38% 178.59% |

| Kirkland's, Inc. Growth y/y (%) | 17.53% 125.33% |

| Bed Bath & Beyond Inc. Growth y/y (%) | -16.09% 62.93% |

- Return on Equity (%): HVT generated a return on equity of 23.38% in Q4 2020, higher than its peer group's median (-1.45%).

- Growth QoQ(%): Achieved a return on equity growth of 57% QoQ in Q4 2020, exceeding its peer group's median (24.49%).

- Growth YoY(%): Achieved a return on equity growth of 178.59% YoY in Q4 2020, exceeding its peer group's median (-28.27%).

2.2Liquidity Ratio (X)

2.2.1CURRENT RATIO (X)

The most common liquidity metric which measures the capability of the business to meet its short-term obligations that are due within a year. Current Ratio = Current Assets Current Liabilities (in times)

| The most common liquidity metric which measures the capability of the business to meet its short-term obligations that are due within a year. | |

| Current Ratio = | Current Assets |

| Current Liabilities (in times) | |

1.55x

Current Ratio (X)

1.61x

Current Ratio (X) – Last Year

1.41x

Furniture & Home: Current Ratio (X)

| Top Furniture & Home Companies by optimally maintaining the Current Ratio | CONN | TUES | AAN | Current Ratio(X) | 4.47x | 3x | 2.22x |

|---|---|---|---|

| Current Ratio(X) – Last Year | 4.92x | 1.31x | 3.01x |

- Current Ratio: HVT's current ratio (1.55x) was within the industry optimal range, indicating an ability to cover all of its short-term obligations.

A Current Ratio between 1.5 times to 3.0 times is considered optimal.

2.2.2QUICK RATIO (X)

The ratio measures the ability of the business to pay its short-term liabilities with assets readily covertible into cash. Quick Ratio = (Total Current Assets-Inventories) Total Current Liabilities (in times)

| The ratio measures the ability of the business to pay its short-term liabilities with assets readily covertible into cash. | |

| Quick Ratio = | (Total Current Assets-Inventories) |

| Total Current Liabilities (in times) | |

1.11x

Quick Ratio (X)

0.78x

Quick Ratio (X) – Last Year

0.67x

Furniture & Home: Quick Ratio (X)

| Top Furniture & Home Companies by optimally maintaining the Quick Ratio | CONN | W | LZB | Quick Ratio(X) | 3.47x | 1.38x | 1.23x |

|---|---|---|---|

| Quick Ratio(X) – Last Year | 3.76x | 0.82x | 1.23x |

- Quick Ratio: HVT's quick ratio (1.11x) was within the industry optimal range, indicating that it has enough liquid assets to instantly pay off its current liabilities.

A Quick Ratio between 1.0 times to 2.0 times is considered optimal.

2.2.3CASH RATIO (X)

A ratio that indicates Company's capacity to pay-off short term debt obligatons with its cash and cash equivalents. Cash Ratio = Cash and Cash Equivalents Total Current Liabilities (in times)

| A ratio that indicates Company's capacity to pay-off short term debt obligatons with its cash and cash equivalents. | |

| Cash Ratio = | Cash and Cash Equivalents |

| Total Current Liabilities (in times) | |

0.98x

Cash Ratio (X)

0.6x

Cash Ratio (X) – Last Year

0.43x

Furniture & Home: Cash Ratio (X)

| Top Furniture & Home Companies by optimally maintaining the Cash Ratio | TUES | W | HVT | Cash Ratio(X) | 1.04x | 0.98x | 0.98x |

|---|---|---|---|

| Cash Ratio(X) – Last Year | 0.02x | 0.36x | 0.6x |

- Cash Ratio: HVT demonstrates abilityto pay off its short-term liabilities to a large extent, using its cash reserves.

We consider companies with ratio between 0.5 times to 1.0 times to be optimal.

2.3Stability Ratio (X)

2.3.1FIXED ASSET RATIO (X)

The ratio measures the amount of fixed assets being financed by each unit of long term funds. Fixed Asset Ratio = Fixed Assets Long Term Funds

| The ratio measures the amount of fixed assets being financed by each unit of long term funds. | |

| Fixed Asset Ratio = | Fixed Assets |

| Long Term Funds | |

0.43x

Fixed Asset Ratio (X)

0.6x

Fixed Asset Ratio (X) – Last Year

0.47x

Furniture & Home: Fixed Asset Ratio (X)

| Top Furniture & Home Companies by Fixed Asset Ratio | TUES | PIR | HOME | Fixed Asset Ratio(X) | 2.48x | 0.96x | 0.86x |

|---|---|---|---|

| Fixed Asset Ratio(X) – Last Year | 0.5x | 0.45x | 0.76x |

- Negative: A lower fixed asset ratio of 0.27x compared to the industry average of 3.0x indicates company might face difficulty in paying off its debt using fixed assets in case of bankruptcy.

2.3.2CURRENT ASSET TO FIXED ASSET RATIO (X)

The ratio measures the amount of money tied up by the company in current asset & fixed assets. Current Ratio to Fixed Asset Ratio = Current Asset Fixed Assets

| The ratio measures the amount of money tied up by the company in current asset & fixed assets. | |

| Current Ratio to Fixed Asset Ratio = | Current Asset |

| Fixed Assets | |

2.92x

CA / FA (X)

1.31x

CA / FA (X) – Last Year

2.73x

Furniture & Home: CA / FA Ratio (X)

| Top Furniture & Home Companies by Current Asset to Fixed Asset Ratio (x) | RCII | CONN | W | CA / FA Ratio (x) | 8.57x | 5.07x | 4.45x |

|---|---|---|---|

| CA / FA Ratio (x) – Last Year | 6.27x | 6.08x | 2.21x |

- Positive: The company has better current asset to fixed asset ratio of 1.77x compared to the industry average of 1.67x.

2.3.3Proprietary Ratio (X)

The ratio is an estimate of the amount of capitalization currently used to support a busniess. The higher ratio indicates that a company has sufficient amount of equity to support the functions of the business and can probably take on additional debt, if necessary. Proprietary Ratio = Total Shareholders Equity Total Assets (in times)

| The ratio is an estimate of the amount of capitalization currently used to support a busniess. The higher ratio indicates that a company has sufficient amount of equity to support the functions of the business and can probably take on additional debt, if necessary. | |

| Proprietary Ratio = | Total Shareholders Equity |

| Total Assets (in times) | |

0.37x

Proprietary Ratio (X)

0.47x

Proprietary Ratio (X) – Last Year

0.33x

Furniture & Home: Proprietary Ratio (X)

| Top Furniture & Home Companies by Proprietary Ratio (x) | ETH | AAN | LZB | Proprietary Ratio (x) | 0.55x | 0.53x | 0.45x |

|---|---|---|---|

| Proprietary Ratio (x) – Last Year | 0.58x | 0.53x | 0.51x |

- Proprietary Ratio: HVT's proprietary ratio (0.37x) is low, reflecting a high dependency on debts for its business operations.

We consider Proprietary Ratio below 0.45 times to be low.

- Peer Comparison: HVT's creditors appear to be more secured as compared to its peer group (0.33x).

2.4Financial Risk Ratio (X)

2.4.1Debt to Equity Ratio (X)

Measures how much a company is financing its operations through debt versus wholly-owned funds. The higher the ratio, the more debt a company uses to fund its operations. Debt to Equity Ratio = (Short Term Debt+Long Term Debt) Total Shareholders Equity

| Measures how much a company is financing its operations through debt versus wholly-owned funds. The higher the ratio, the more debt a company uses to fund its operations. | |

| Debt to Equity Ratio = | (Short Term Debt+Long Term Debt) |

| Total Shareholders Equity | |

-x

D / E Ratio (X)

-x

D / E Ratio (X) – Last Year

0.59x

Furniture & Home: D / E Ratio (X)

| Top Furniture & Home Companies by Debt to Equity Ratio (x) | AAN | FND | WSM | D / E Ratio (x) | -0.11x | 0.21x | 0.21x |

|---|---|---|---|

| D / E Ratio (x) – Last Year | 0.2x | 0.19x | 0.35x |

- Comment: The Company had no interest-paying debt outstanding during the period.

2.4.2Interest Coverage Ratio (ICR)

Measures how many times a company can cover its current interest payment with its available earnings. The lower the ratio, the more a debt burden the company has. Interest Coverage Ratio = Operating Income (EBIT) Interest Expense

| Measures how many times a company can cover its current interest payment with its available earnings. The lower the ratio, the more a debt burden the company has. | |

| Interest Coverage Ratio = | Operating Income (EBIT) |

| Interest Expense | |

163.42x

Int. Coverage Ratio (X)

-x

Int. Coverage (X) – Last Year

16.23x

Furniture & Home: Int. Coverage Ratio (X)

| Top Furniture & Home Companies by Interest Coverage Ratio (x) | HVT | LZB | SNBR | Int. Coverage Ratio (x) | 163.42x | 115.48x | 91.75x |

|---|---|---|---|

| Int. Coverage Ratio (x) – Last Year | 0x | 197.41x | 12.59x |

- Interest Coverage Ratio: During Q4 2020, HVT generated enoughoperating income to pay its interest obligations with some extra earnings left over to make the principle payments.

We consider ICR above 1.5 times to be satisfactory.

- Peer Comparison: Its ratio exceed peers' median (16.23), reflecting its creditworthiness and ability to borrow new debt at relatively cheaper rate.

2.4.3Debt Coverage Ratio

The ratio measures the ability of a company to use its EBITDA to repay all debt obligations. Debt Coverage Ratio = EBITDA (Short Term Debt+Interest Expense)

| The ratio measures the ability of a company to use its EBITDA to repay all debt obligations. | |

| Debt Coverage Ratio = | EBITDA |

| (Short Term Debt+Interest Expense) | |

242.49x

Debt Coverage Ratio (X)

-x

Debt Coverage Ratio (X) – Last Year

24.85x

Furniture & Home: Debt Coverage Ratio (X)

| Top Furniture & Home Companies by Debt Coverage Ratio (x) | HVT | LZB | WSM | Debt Coverage Ratio (x) | 242.49x | 88.41x | 58.69x |

|---|---|---|---|

| Debt Coverage Ratio (x) – Last Year | 0x | 130.55x | 5.97x |

- Debt Coverage Ratio: HVT's debt coverage ratio was at 242.49x in Q4 2020, indicating that its cash flow was sufficient to cover both its current debt obligations and capital expenditure program.

- Peer Comparison: Its ratio exceed peers' median (19.18x), reflecting its creditworthiness and ability to borrow new debt at relatively cheaper rate.

2.5Conversion Cycle (in Days)

2.5.1Inventory Days

The average number of days that a company holds its inventory before selling it. Inventory Days = Inventories * 365 Cost of Goods Sold

| The average number of days that a company holds its inventory before selling it. | |

| Inventory Days = | Inventories * 365 |

| Cost of Goods Sold | |

100 Days

Inventory Days

104 Days

Inventory Days – Last Year

109 Days

Furniture & Home: Inventory Days

| Top Furniture & Home Companies by Inventory Days ( in Days) | W | SNBR | KIRK | Inventory Days | 2Days | 42Days | 61Days |

|---|---|---|---|

| Inventory Days – Last Year | 3Days | 49Days | 79Days |

- Inventory Days: HVT took shorter time (100 days) to turn its inventory into sales as compared to its peer group's median (109 days). This may indicate that its business is growing and the management is efficient in inventory management.

- Growth YoY(%): An improvement in inventory days suggest working capital efficiency and that inventory levels are being kept under control in relation to the level of sales. However, maintaining too low inventory levels may eventually result in inventory shortages as demand fluctuates.

2.5.2Receivable Days

Measures the average number of days a company takes to collect payment after making a sale. Receivable Days = Trade Accounts Receivable * 365 Total Revenue

| Measures the average number of days a company takes to collect payment after making a sale. | |

| Receivable Days = | Trade Accounts Receivable * 365 |

| Total Revenue | |

- Days

Receivable Days

1 Days

Receivable Days – Last Year

8 Days

Furniture & Home: Receivable Days

| Top Furniture & Home Companies by Receivable Days ( in Days) | W | AAN | ETH | Receivable Days | 3Days | 5Days | 6Days |

|---|---|---|---|

| Receivable Days – Last Year | 4Days | 10Days | 7Days |

2.5.3Payable Days

Measures the average number of days a company takes to pay off its bills. Payable Days = Trade Accounts Payable * 365 Cost of Goods Sold

| Measures the average number of days a company takes to pay off its bills. | |

| Payable Days = | Trade Accounts Payable * 365 |

| Cost of Goods Sold | |

35 Days

Payable Days

28 Days

Payable Days – Last Year

50 Days

Furniture & Home: Payable Days

| Top Furniture & Home Companies by Payable Days ( in Days) | AAN | FND | RH | Payable Days | 136Days | 110Days | 91Days |

|---|---|---|---|

| Payable Days – Last Year | 239Days | 114Days | 32Days |

- Payable Days: HVT paid its bills relatively quickly (35 days) as compared to its peer group's median (49 days). This may indicate that the Company might be getting more favorable early pay discounts than its peer group and thus it may continue to pay its bills early.

- Growth YoY(%): Increased from 28 days in Q4 2019 to 35 days in Q4 2020 indicating that the company is paying its suppliers more slowly, and may be an indicator of worsening financial condition.

2.5.4Cash Conversion Cycle

Measures the length of time it takes for a company to convert inventory and accounts receivable to cash and pay bills. Coversion Cycle = Inventory Days+Receivable Days-Payable Days

| Measures the length of time it takes for a company to convert inventory and accounts receivable to cash and pay bills. | |

| Coversion Cycle = | Inventory Days+Receivable Days-Payable Days |

- Days

Cash Conversion Cycle

77 Days

Cash Conversion Cycle – Last Year

74 Days

Furniture & Home: Cash Conversion Cycle

| Top Furniture & Home Companies by Cash Conversion Cycle ( in Days) | W | SNBR | RH | Cash Conversion Cycle | -37Days | 1Days | 40Days |

|---|---|---|---|

| Cash Conversion Cycle – Last Year | -40Days | -23Days | 74Days |

2.6Revolving Credit (in Million USD)

2.6.1Total Line of Credit

Measures the length of time it takes for a company to convert inventory and accounts receivable to cash and pay bills.

| Measures the length of time it takes for a company to convert inventory and accounts receivable to cash and pay bills. |

$60 Mn

Total Line of Credit [LOC] (in $ Mn)

$0 Mn

Revolving Credit Borrowing [RCB] (in $ Mn)

$15.3 Mn

Revolver Available [RA] (in $ Mn)

| Company - Total LOC |

Furniture & Home - Total LOC |

Company - RCB |

Furniture & Home - RCB |

Company - RA |

Furniture & Home - RA |

|

|---|---|---|---|---|---|---|

| Anual Growth (%) | 0% | 0% | 0% | -100% | 0% | -1.4% |

| 3-Year CAGR (%) | - | - | - | - | - | - |

| Quarter Growth (%) | 0% | 0% | 0% | -100% | 0% | -2% |

- Total Line of Credit: At the end of Q4 2020, HVT's total line of credit, under the "Revolving Credit Facility", remained unchanged YoY at $60 million.

- Revolver Available: At the end of Q4 2020, HVT's revolver available, under the "Revolving Credit Facility", decreased by 71.82% YoY to $15.3 million.

2.6.2Revolver Availability (%)

Revover Availability (%) = Revolver Available (in $ million) * 100 TLOC or Borrowing Base

| Revover Availability (%) = | Revolver Available (in $ million) * 100 |

| TLOC or Borrowing Base |

100%

Revolver Availability [RA] (%)

100%

Revolver Availability (%) – Last Year

72.53%

Furniture & Home: Revolver Availability (%)

| Company - RA (%) |

Furniture & Home - RA (%) |

|

|---|---|---|

| RA (%) | 100% | 72.53% |

| Change y/y (%) | 0% | -1.4% |

| Change q/q (%) | 0% | -2.04% |

| Top Furniture & Home Companies by RA (%) - Revolver Availability & Growth y/y (%) |

|

|---|---|

| Haverty Furniture Companies, Inc. Growth y/y (%) | 100.00% 0.00% |

| The Container Store Group, Inc. Growth y/y (%) | 97.20% 116.75% |

| Williams-Sonoma, Inc. Growth y/y (%) | 97.07% 8.62% |

| Top Furniture & Home Companies by % △ in RA (%) - Revolver Availability & Growth y/y (%) |

|

|---|---|

| The Container Store Group, Inc. Growth y/y (%) | 97.20% 116.75% |

| At Home Group Inc. Growth y/y (%) | 73.55% 107.43% |

| Conn's, Inc. Growth y/y (%) | 95.77% 78.26% |

2.6.3Total Liquidity (in Million USD)

Liquidity refers to the ease with which an asset can be readily converted into cash without affecting its market price.

| Liquidity refers to the ease with which an asset can be readily converted into cash without affecting its market price. |

$215.36 Mn

Total Liquidity (in $ Mn)

65.61%

Change y/y (%)

60.05%

Furniture & Home: Change y/y (%)

| Company - Total Liquidity |

Furniture & Home - Total Liquidity |

|

|---|---|---|

| Annual Growth (%) | 65.6% | 60% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | -4.9% | 6.8% |

| Top Furniture & Home Companies by Total Liquidity - Total Liquidity (in $ Mn) & Change y/y (%) |

|

|---|---|

| Wayfair Inc. Growth y/y (%) | $2,272Mn 224.15% |

| Bed Bath & Beyond Inc. Growth y/y (%) | $2,175Mn 89.08% |

| Williams-Sonoma, Inc. Growth y/y (%) | $1,487Mn 123.75% |

| Top Furniture & Home Companies by % △ in Total Liquidity - Total Liquidity (in $ Mn) & Change y/y (%) |

|

|---|---|

| Wayfair Inc. Growth y/y (%) | $2,272Mn 224.15% |

| At Home Group Inc. Growth y/y (%) | $438.44Mn 169.34% |

| Floor & Decor Holdings, Inc. Growth y/y (%) | $686.47Mn 123.94% |

- Total Liquidity: At the end of Q4 2020, HVT's total liquidity, comprising of cash & cash equivalents and revolver availability under the "Revolving Credit Facility", increased by 65.61% YoY to $215.36 million.

2.7Other Ratios

2.7.1Fixed Charge Coverage Ratio (FCCR)

The FCCR (Fixed Charge Coverage Ratio) shows how well a company's earnings cover its fixed charges, such as debt payments, interest expense and rental expenses. FCCR = (EBIT+Rent Expense) (Interest Expense+Rent Expense)

| The FCCR (Fixed Charge Coverage Ratio) shows how well a company's earnings cover its fixed charges, such as debt payments, interest expense and rental expenses. | |

| FCCR = | (EBIT+Rent Expense) |

| (Interest Expense+Rent Expense) | |

3.23x

Fixed Charge Coverage Ratio [FCCR] (x)

1.62x

FCCR (x) – Last Year

2.2x

Furniture & Home: FCCR (x)

| Top Furniture & Home Companies by Fixed Charge Coverage Ratio (x) | LZB | WSM | SNBR | FCCR (x) | 115.48x | 51.39x | 4.09x |

|---|---|---|---|

| FCCR (x) – Last Year | 3.78x | 2.29x | 2.2x |

- Fixed Charge Coverage Ratio: HVT's fixed charge coverage ratio was at 3.23x in Q4 2020, indicating that its cash flow was sufficient to cover its fixed payment obligations as well as capital expenditure plans.

- Peer Comparison: Its ratio exceed peers' median (2.12x), reflecting its creditworthiness and ability to borrow new debt at more favorable rates.

2.7.2Lease Adjusted Debt (in Million USD)

Lease Adjusted Debt refers to the total short term and Long term debt of the Company. Lease Adjusted Debt = Short Term Debt + Long Term Debt + Short Term Operating Lease + Long Term Operating Lease

| Lease Adjusted Debt refers to the total short term and Long term debt of the Company. |

| Lease Adjusted Debt = Short Term Debt + Long Term Debt + Short Term Operating Lease + Long Term Operating Lease |

$233.67 Mn

Lease Adjusted Debt [LAD] (in $ Mn)

30.54%

Change y/y (%)

9.45%

Furniture & Home: Change y/y (%)

- Lease Adjusted Debt: At the end of Q4 2020, HVT's lease adjusted debt increased by 30.54% YoY to $233.67 million.

2.7.3Debt to EBITDA Ratio

Measures company's ability to pay off its debt. The Debt to EBITDA ratio indicates as to how long a company would need to operate at its current level to pay off all its debt. EBITDA Ratio = (Short Term Debt + Long Term Debt) EBITDA

| Measures company's ability to pay off its debt. The Debt to EBITDA ratio indicates as to how long a company would need to operate at its current level to pay off all its debt. | |

| EBITDA Ratio = | (Short Term Debt + Long Term Debt) |

| EBITDA | |

0x

Debt to EBITDA (x)

0x

Debt to EBITDA (x) – Last Year

0.66x

Furniture & Home: Debt to EBITDA (x)

| Top Furniture & Home Companies by Debt to EBITDA (x) | LZB | HVT | KIRK | Debt to EBITDA (x) | 0x | 0x | 0x |

|---|---|---|---|

| Debt to EBITDA (x) – Last Year | 0x | 0x | 0x |

- Comment: HVT had no interest-paying debt outstanding.

- Peer Comparison: Ratio less than its peers' median (0.68x), reflecting that HVT's is in a better position to meet its debt repayment obligations on time.

2.8Cash Flow Management

2.8.1Cash Flow From Operating Activities (CFO)

Measures the amount of cash a company generates from its core business activities in a given period to know if it is sufficient enough to fund its operations or if it may require external financing.

| Measures the amount of cash a company generates from its core business activities in a given period to know if it is sufficient enough to fund its operations or if it may require external financing. |

$30.37 Mn

Cash Flow from Operating Activities [CFO]

501.15%

Change y/y (%)

126.35%

Furniture & Home: Change y/y (%)

| Company - CFO |

Furniture & Home - CFO |

|

|---|---|---|

| Annual Growth (%) | 501.1% | 126.3% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | - | - |

| Top Furniture & Home Companies by CFO - CFO (in $ Mn) & Change y/y (%) |

|

|---|---|

| Bed Bath & Beyond Inc. Growth y/y (%) | $43.54Mn 3457.52% |

| Aaron's, Inc. Growth y/y (%) | -$196.08Mn -484.00% |

| Bassett Furniture Industries, Inc. Growth y/y (%) | $19.19Mn 61.71% |

| Top Furniture & Home Companies by % △ in CFO - CFO (in $ Mn) & Change y/y (%) |

|

|---|---|

| Ethan Allen Interiors Inc. Growth y/y (%) | $23.73Mn 296700.00% |

| Bed Bath & Beyond Inc. Growth y/y (%) | $43.54Mn 3457.52% |

| Floor & Decor Holdings, Inc. Growth y/y (%) | $136.48Mn 2864.97% |

- Cash Flow From Operating Activities: During Q4 2020, HVT's net cash flow from operating activities increased by 501.15% YoY to $30.37 million.

2.8.2Capital Expenditure (CAPEX)

Capital expenditures are funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, plant and equipment. Capital Expenditure(CAPEX) = Purchase of Tangibles + Purchase of Intangibles + Capitilized Software Expenses

| Capital expenditures are funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, plant and equipment. |

| Capital Expenditure(CAPEX) = Purchase of Tangibles + Purchase of Intangibles + Capitilized Software Expenses |

$3.72 Mn

Capital Expenditure [CAPEX] (in $ Mn)

15.31%

Change y/y (%)

27.34%

Furniture & Home: Change y/y (%)

| Company - CAPEX |

Furniture & Home - CAPEX |

|

|---|---|---|

| Annual Growth (%) | -15.3% | -27.3% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | - | - |

| Top Furniture & Home Companies by CAPEX - CAPEX (in $ Mn) & Change y/y (%) |

|

|---|---|

| Floor & Decor Holdings, Inc. Growth y/y (%) | $102.79Mn 86.92% |

| Wayfair Inc. Growth y/y (%) | $78.45Mn -35.81% |

| Williams-Sonoma, Inc. Growth y/y (%) | $48.76Mn 10.91% |

| Top Furniture & Home Companies by % △ in CAPEX - CAPEX (in $ Mn) & Change y/y (%) |

|

|---|---|

| Floor & Decor Holdings, Inc. Growth y/y (%) | $102.79Mn 86.92% |

| Rent-A-Center, Inc. Growth y/y (%) | $12.99Mn 41.99% |

| Williams-Sonoma, Inc. Growth y/y (%) | $48.76Mn 10.91% |

- Capital Expenditure: During Q4 2020, HVT's capital expenditure decreased by 15.31% YoY to $3.72 million.

2.8.3Dividends Paid

Dividend refers to distribution of Company's earnings to shareholders as a reward for their investment in the company's equity.

| Dividend refers to distribution of Company's earnings to shareholders as a reward for their investment in the company's equity. |

$40.25 Mn

Dividend Paid (in $ Mn)

942.21%

Change y/y (%)

1.15%

Furniture & Home: Change y/y (%)

| Company - Dividend Paid |

Furniture & Home - Dividend Paid |

|

|---|---|---|

| Annual Growth (%) | 942.2% | -1.2% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | - | - |

| Top Furniture & Home Companies by Dividend Paid - Dividend Paid (in $ Mn) & Change y/y (%) |

|

|---|---|

| Williams-Sonoma, Inc. Growth y/y (%) | $76.88Mn 103.89% |

| Haverty Furniture Companies, Inc. Growth y/y (%) | $40.25Mn 942.21% |

| Rent-A-Center, Inc. Growth y/y (%) | $15.79Mn 15.20% |

| Top Furniture & Home Companies by % △ in Dividend Paid - Dividend Paid (in $ Mn) & Change y/y (%) |

|

|---|---|

| Haverty Furniture Companies, Inc. Growth y/y (%) | $40.25Mn 942.21% |

| Williams-Sonoma, Inc. Growth y/y (%) | $76.88Mn 103.89% |

| Rent-A-Center, Inc. Growth y/y (%) | $15.79Mn 15.20% |

- Dividends Paid: For the period ended Q4 2020, total dividend paid by HVT increased by 942.21% YoY to $40.25 million.

2.8.4Free Cash Flow (FCF)

Free cash flow (FCF) represents the cash left with the company after it pays for ts operating expenses and capital expenditures and is available for distribution to the shareholders of the Company. FCF = Cash Flow From Operating Activities - Capital Expenditure

| Free cash flow (FCF) represents the cash left with the company after it pays for ts operating expenses and capital expenditures and is available for distribution to the shareholders of the Company. |

| FCF = Cash Flow From Operating Activities - Capital Expenditure |

$26.65 Mn

Free Cash Flow (in $ Mn)

3956.01%

Change y/y (%)

152.48%

Furniture & Home: Change y/y (%)

| Company - Free Cash Flow |

Furniture & Home - Free Cash Flow |

|

|---|---|---|

| Annual Growth (%) | 3956% | 152.5% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | - | - |

| Top Furniture & Home Companies by Free Cash Flow - Free Cash Flow (in $ Mn) & Change y/y (%) |

|

|---|---|

| Williams-Sonoma, Inc. Growth y/y (%) | $461.47Mn 535.44% |

| RH Growth y/y (%) | $194.76Mn 161.31% |

| Wayfair Inc. Growth y/y (%) | $128.29Mn 180.93% |

| Top Furniture & Home Companies by % △ in Free Cash Flow - Free Cash Flow (in $ Mn) & Change y/y (%) |

|

|---|---|

| Haverty Furniture Companies, Inc. Growth y/y (%) | $26.65Mn 3956.01% |

| Conn's, Inc. Growth y/y (%) | $65.55Mn 650.44% |

| Ethan Allen Interiors Inc. Growth y/y (%) | $20.29Mn 542.89% |

- Free Cash Flow: During Q4 2020, HVT's free cash flow increased by 3956.01% YoY to $26.65 million.

2.8.5Free Cash Flow per Store

Free Cash Flow Per Store = FCF No. of Stores

| Free Cash Flow Per Store = | FCF |

| No. of Stores |

$0.22 Mn

Free Cash Flow [FCFF] per Store

3989.81%

Change y/y (%)

150.71%

Furniture & Home: Change y/y (%)

| Company - FCFF per Store |

Furniture & Home - FCFF per Store |

|

|---|---|---|

| Annual Growth (%) | 3989.8% | 150.7% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | - | - |

| Top Furniture & Home Companies by FCFF per store - FCFF per Store (in $ Mn) & Change y/y (%) |

|

|---|---|

| RH Growth y/y (%) | $2.38Mn 170.87% |

| Williams-Sonoma, Inc. Growth y/y (%) | $0.75Mn 547.86% |

| Conn's, Inc. Growth y/y (%) | $0.46Mn 627.35% |

| Top Furniture & Home Companies by % △ in FCFF per store - FCFF per Store (in $ Mn) & Change y/y (%) |

|

|---|---|

| Haverty Furniture Companies, Inc. Growth y/y (%) | $0.22Mn 3989.81% |

| Conn's, Inc. Growth y/y (%) | $0.46Mn 627.35% |

| Williams-Sonoma, Inc. Growth y/y (%) | $0.75Mn 547.86% |

- Free Cash Flow per Store: During Q4 2020, HVT's free cash flow per store increased by 3989.81% YoY to $0.22 million.

- Peer Comparison: Its free cash flow per store was greater than its peers' median ($0.14 million).

2.8.6Free Cash Flow per Square Feet

Free Cash Flow Per Square Feet = FCF Gross SQFT

| Free Cash Flow Per Square Feet = | FCF |

| Gross SQFT |

$6.12

Free Cash Flow [FCFF] per Sq. Ft.

4024.98%

Change y/y (%)

146.66%

Furniture & Home: Change y/y (%)

| Company - FCFF per Sq. Ft. |

Furniture & Home - FCFF per Sq. Ft. |

|

|---|---|---|

| Annual Growth (%) | 4025% | 146.7% |

| 3-Year CAGR (%) | - | - |

| Quarter Growth (%) | - | - |

| Top Furniture & Home Companies by FCFF per Sq. Ft. - FCFF per Sq. Ft. (in $) & Change y/y (%) |

|

|---|---|

| RH Growth y/y (%) | $168.04 146.66% |

| Williams-Sonoma, Inc. Growth y/y (%) | $111.38 537.13% |

| Kirkland's, Inc. Growth y/y (%) | $21.12 41.67% |

| Top Furniture & Home Companies by % △ in FCFF per Sq. Ft. - FCFF per Sq. Ft. (in $) & Change y/y (%) |

|

|---|---|

| Haverty Furniture Companies, Inc. Growth y/y (%) | $6.12 4024.98% |

| Conn's, Inc. Growth y/y (%) | $12.62 622.17% |

| Ethan Allen Interiors Inc. Growth y/y (%) | $9.40 551.92% |

- Free Cash Flow per Square Feet: During Q4 2020, HVT's free cash flow per square feet increased by 4024.98% YoY to $6.12.

- Peer Comparison: Its free cash flow per square feet was greater than its peers' median $3.17.

2.8.7Free Cash Flow to Dividend (X)

0.66x

Free Cash Flow [FCFF] to Dividend (x)

0.17x

FCFF to Dividend (x)– Last Year

308.68x

Furniture & Home: FCFF to Dividend (x)

| Top Furniture & Home Companies by Free Cash Flow to Dividend (x) | BBBY | AAN | BSET | FCFF to Dividend (x) | 59.67x | 26.66x | 12.42x |

|---|---|---|---|

| FCFF to Dividend (x) – Last Year | 0x | 0x | 4.06x |